Max Amount Of Social Security Tax 2025 - Are My Social Security Benefits Taxable Calculator, The highest social security retirement benefit for an individual starting benefits in 2025 is $4,873 per month, according to the social security. More than 71 million americans will see a 3.2% increase in their social security benefits and supplemental security. Calculate Social Security Taxable Amount, More than 71 million americans will see a 3.2% increase in their social security benefits and supplemental security. So, if you earned more than $160,200 this.

Are My Social Security Benefits Taxable Calculator, The highest social security retirement benefit for an individual starting benefits in 2025 is $4,873 per month, according to the social security. More than 71 million americans will see a 3.2% increase in their social security benefits and supplemental security.

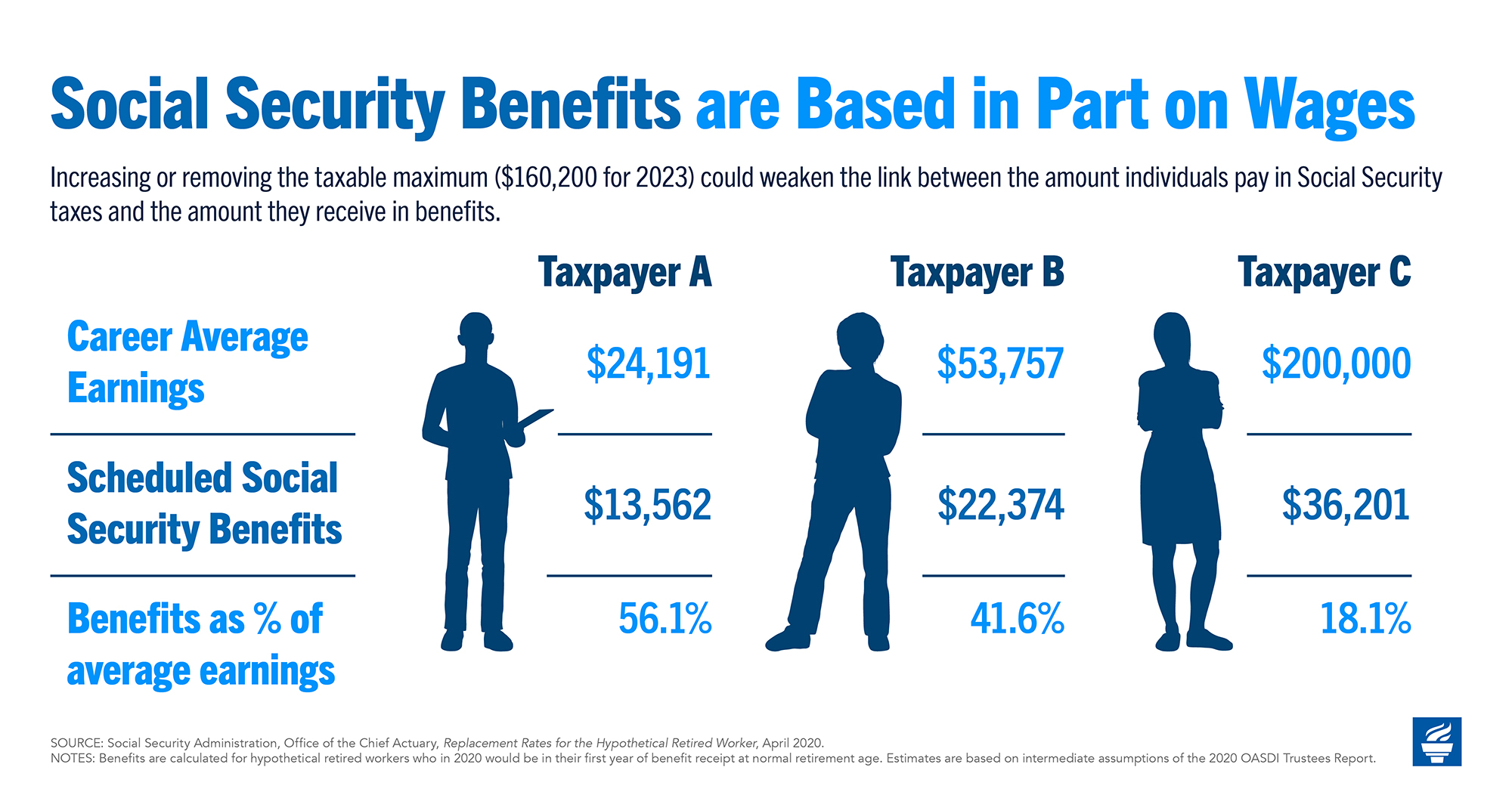

Save Your Social Security COLA Notice, We call this annual limit the contribution and benefit base. It’s estimated that 60% of retirees will owe no federal income taxes on their social security benefits, which may be why many believe social security.

Max Amount Of Social Security Tax 2025. Up to 50% of your social security benefits are taxable if: If it's any consolation, in prior years, the maximum income subject to social.

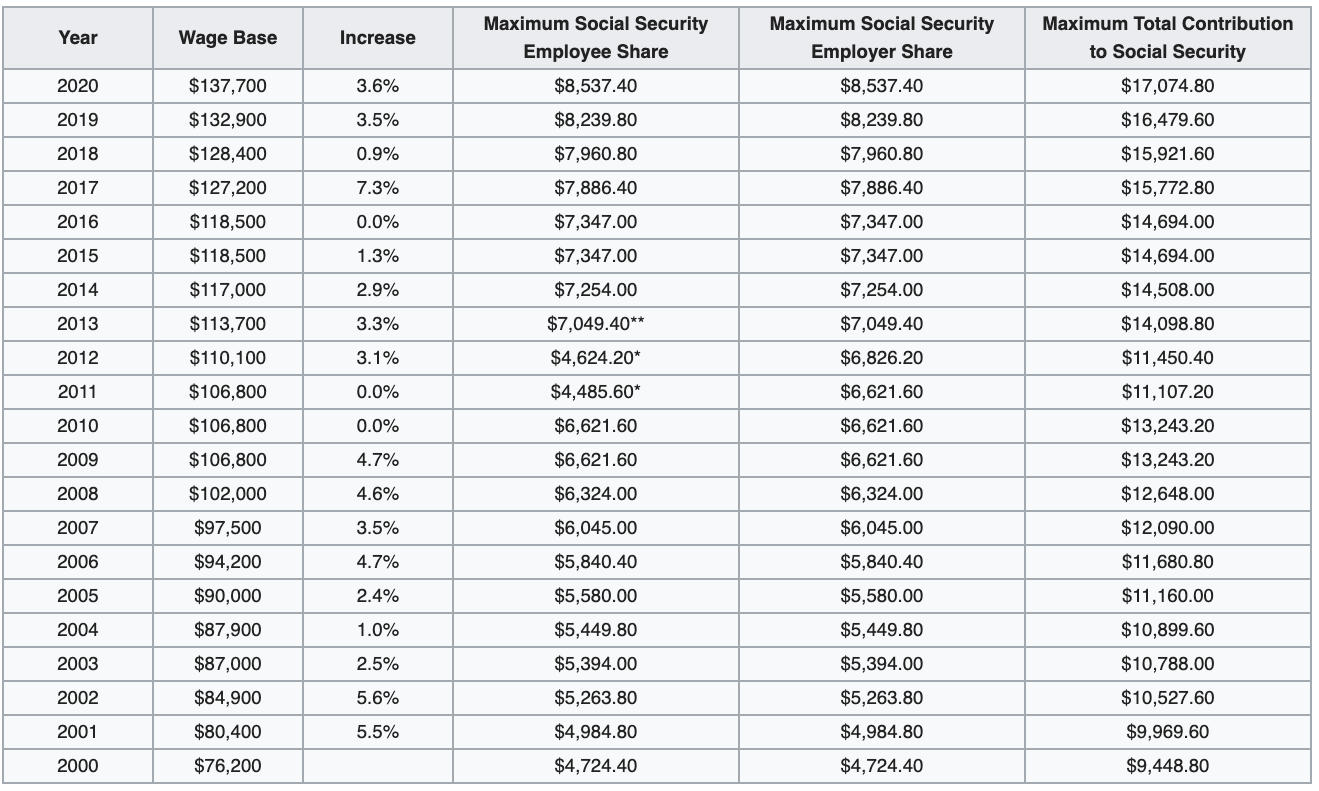

Social Security GuangGurpage, 11 rows if you are working, there is a limit on the amount of your earnings that is taxed by social security. If it's any consolation, in prior years, the maximum income subject to social.

Social Security Tax (The Sneakiest Tax You WILL Pay) YouTube, In 2025, this limit rises to $168,600, up from the 2023 limit of $160,200. The limit for 2023 and 2025 is $25,000 if you are a single filer, head of household or qualifying widow or widower with a dependent child.

Maximum Taxable Amount For Social Security Tax (FICA), So, if you earned more than $160,200 this. As kiplinger reported, the social security tax wage base jumped 5.2% from 2023 to 2025.

Tax Calculator California 2025 Barb Marice, As kiplinger reported, the social security tax wage base jumped 5.2% from 2023 to 2025. The maximum social security benefit in 2025 is $3,822 per month at full retirement age.

More than 71 million americans will see a 3.2% increase in their social security benefits and supplemental security.

If it’s any consolation, in prior years, the maximum income subject to social.

Social Security 2025 COLA Amount YouTube, For 2025, the social security tax limit is $168,600. As a result, in 2025 you’ll pay no more than $10,453 ($168,600 x 6.2%) in social.

11 rows if you are working, there is a limit on the amount of your earnings that is taxed by social security.